Setting the Benchmark for Business Efficiency

ECM Consulting Services for Banks and Credit Unions | IDT, Inc.

Streamlined Lending and Servicing Technology Solutions for Regional and Community Banks and Credit Unions

Feeling hampered by increasing regulations? Community and Regional Banks and Loan Servicers are being transformed by seemingly endless regulations imposed and implemented by the Consumer Financial Protection Bureau (CFBP). HMDA Reporting, Regulation Z, the S.A.F.E. Act, Regulation B, FACT Act, HUD 1/1A, BSA Requirements, the list goes on...

Ensuring compliance with the new mandates can be challenging when you are already trying to do more with less and keep costs down while seeking to drive more business. Reviewing new mandates and updating policies and procedures can prove a substantial drain on time and resources.

Add to the complexities in your industry are the subjects of Customer Communications, Complex Document Composition & Content Delivery, Document & Records Retention, Robotic Processing Automation (RPA), as well as Crisis and Incident Management.

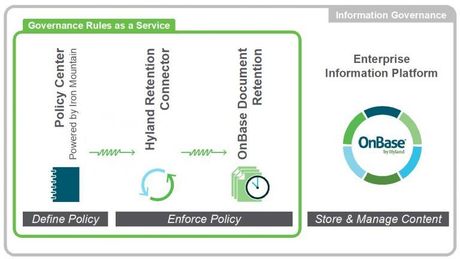

But help is available from Integrated Document Technologies, Inc. (IDT). Our affordable AI-driven Intelligent Document Processing, Content Services, Governance Rules as a Service (GRaaS), and ECM consulting expertise are designed to let you effortlessly navigate the regulatory rapids.

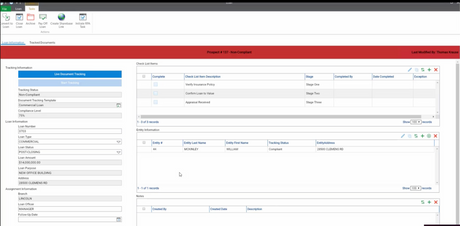

We offer document imaging, workflow, case management, GRaaS, enterprise file sync, and share and AI-driven data extraction and document classification services that seamlessly integrate with your Loan Origination Systems (LOS) such as Empower, Fiserv, ISGN's Tempo Default Management software to create a 21st Century Loan Process and Loan Servicing end to end solution that is hosted in state of the art data-centers such as Microsoft Azure or Hyland Software's data-centers. It is a complete system that will be available whenever you need it. Azure and Hyland's GCS data centers meet the most stringent security guidelines for the financial services industry.

Robotic Process Automation: Robotic process automation, or RPA, is an essential element of an end-to-end business process automation strategy in the financial services sector. With RPA, a digital workforce made up of bots complements your human workforce by allowing both to perform – and excel – at tasks that play to their strengths and provide optimum value for the organization.

With RPA, you can move the burden of tedious and tiresome tasks from your employees’ workload to a “digital workforce” – freeing up their time to focus on high-value tasks and build more meaningful, relevant connections with the people they serve.

Click here to learn more about RPA solutions from IDT and Hyland Software featuring Hyland RPA.

Announcing IoT Smart Connected Scanning solutions powered by CAPSYS CAPTURE ONLINE. In just under 5 minutes using patented QR Code technology, you can deploy a full-featured data and document solution that captures all your various types of documents and pushes them into your business processes through the convenience of a button-driven end-user experience.

Learn more about IoT Smart Connected Scanning solutions from IDT powered by CAPSYS CAPTURE ONLINE.

Crisis and Incident Management: We have identified a number of ways we can immediately help you address needs related to empowering your remote workforce, ensuring business continuity, responding to staffing impacts, and scaling for system demand.

Click here to learn more about Crisis and Incident Management Application solutions from IDT and Hyland Software featuring OnBase App Builder.

Oh Yes, you can! Finally, achieve automated document retention using Governance Rules as a Service from IDT and Hyland OnBase.

Learn more about GRaaS solutions available from IDT and Hyland

Streamline your loan document handling, loan origination, and loan servicing processes with content services, document imaging, classification, and workflow services from IDT.

Digitally sign your Loan Documents using legally binding signature technology from IDT and Docusign. Click here to find out how!

Document Management

Key to lowering the costs for the loan process, IDT uses workflow and document management from Hyland OnBase™ and CAPSYS CAPTURE™ to fully automate your loan data capture and underwriting process.

Available exclusively from IDT, receive a free Epson DS-530 Document Image Scanner with the purchase of CAPSYS CAPTURE ONLINE. Click here to get the details!

Drive efficiency by choosing Cloud, Hybrid-Cloud or On-Premise content services and document management systems for Loan Processing. All ECM solutions include design and setup, software, hardware, training and more.

Read All About it! and learn how a Regional Mortgage Processor reduced loan processing costs from $45.00 per loan to under $7.00 as featured in American Banker.

With more than 125+ years of combined industry experience, IDT is a full-service consulting firm focused on providing credit unions, community and regional banks with integrated content service solutions tailored to meet your needs.

Contact our lending and loan servicing solutions company featuring Robotic Processing Automation and partner with IDT today to get started. Organizations across the nation have benefitted from our work.