Achieving a Paperless Audit Process

Achieving a Paperless Audit Process

Business Problem & Current Process Background

There a number of different types of audits that can and do occur in any organization. They can be summarized as follows:

- Ad Hoc Audits;

- Process Audits and;

- System/Security Audits.

These types of audits can and do occur both internally as well as externally.

Let’s examine a major financial institution’s current process as it relates to completing internal as well as external audits on loans that are funded or closed on a monthly basis. In the past, these manual audits have created a great deal of paper for tracking and at the end of the process, the work papers need to be digitized and stored for future reference – creating the dreaded paper trail.

Familiar Sounding Story

Because the process has been manual in nature, they were limited in terms of the number of loans they could audit in a given period resulting in using a “spot check” or “Ad Hoc” approach. Sound familiar? Using an Ad Hoc approach creates risk because loans could slip through that do not meet compliance requirements, resulting in errors or fines from bank auditors.

The previous audit process consisted of creating of a paper-based folders full of work papers – a case file if you will - that starts with identification and the selection of loans, the creation of the file folder (a container), printing of specific documents related to the loan in question and finally the distribution of the file folders to the audit staff for review and determinations.

During the audit process, which can take long periods of time, additional supporting documents are obtained from various 3rd parties. The document requests are not limited to and can include the following:

- Credit bureau reports;

- Employment verifications;

- Banking information and;

- Appraisals.

These items are received by the auditors and printed out, reviewed and then placed into the case file. Once the auditing process has been completed, the paper file is delivered to the imaging department and the contents are digitized and stored in their Content Services Platform system for future reference, the paper case file is then stored and retained in an offsite location until approved for destruction.

Auditing 100% of your Loan Portfolio is Finally Available

IDT offers a solution that removes the need for paper files and creates a “paperless” audit case management driven process, where the content and results can be contained and managed in an application that is purpose built for the job at hand. Tasks, task assignments, due dates, content and the process behind it all can be easily accessible by all parties involved in the process and the results can be made available to internal parties as well such as 3rd party governing agencies like the FHA, Freddie Mac and Banking and Loan Investors.

By combining an electronic checklist of sorts powered by a case management application that comprises of automated workflow, task lists, task assignments directed at people, electronic forms along with introduction of an Enterprise File Sync and Share tool (EFSS), the internal and external audit process is dramatically improved as well as providing a complete audit trail of who/what/where/when/how – across all loan packages, not just a select few.

Auditing 100% of your loan portfolio can now finally be achieved! Missing documents, critical dates, any non-compliance items that fall out of tolerance can quickly be identified and corrected before any penalties or violations are assessed.

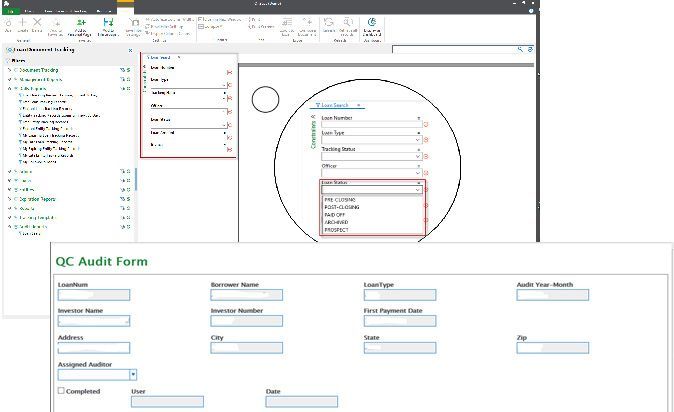

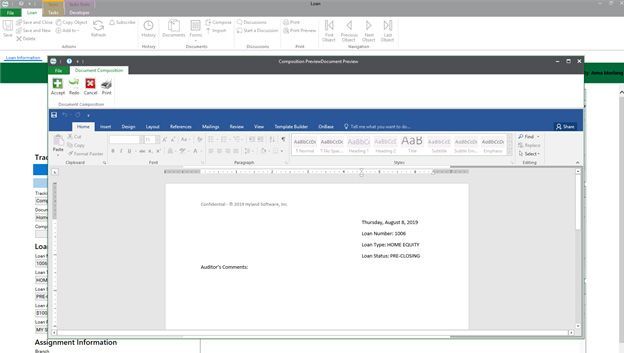

The selected list of loans for review are dropped into an "electronic case file” or case management application managed and monitored by a workflow process which also contains electronic web-based forms. The electronic form is designed to track comments along with the progress of the audit throughout its completion. The electronic web form to the internal audit team looks like as follows:

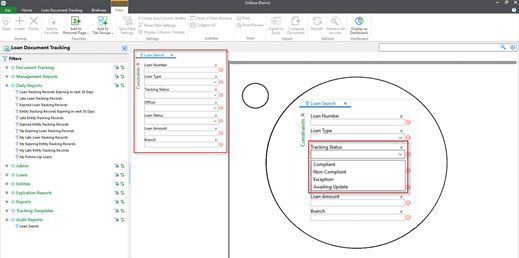

Searching and Tracking Status

We can search a loan’s state or condition by a tracking a “status” field.

In this application we are tracking compliance of our internal loan documents (vs. loan servicing), to make sure all required documents were provided, that they are recent and up to date according to the underwriting procedures.

We can also pull up a list of non-compliant loans or loans that fall out of tolerance according to your best practices. Or, we can even retrieve a list of compliant loans to double check their compliance and fall within tolerance levels.

Automated Correspondence and Document Composition

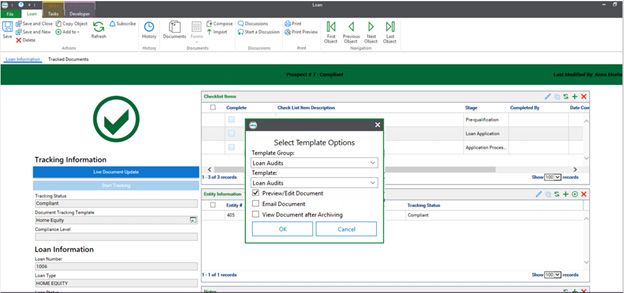

Let’s take a look at how audit reporting can be used to provide and drive information about the audit that was completed – leading to correspondence generation (internal or external). We can do it by generating an output with our audit findings.

We can have a pre-configured template we can use that we can select on any given loan.

Automated Correspondence and Document Composition

Let’s take a look at how audit reporting can be used to provide and drive information about the audit that was completed – leading to correspondence generation (internal or external). We can do it by generating an output with our audit findings.

We can have a pre-configured template we can use that we can select on any given loan.

And, we can have that same information from our loan automatically populate on the correspondence – in this case, created automatically using MS-WORD/ Microsoft Office 365.

Now, we can complete this document by filling in our findings from auditing.

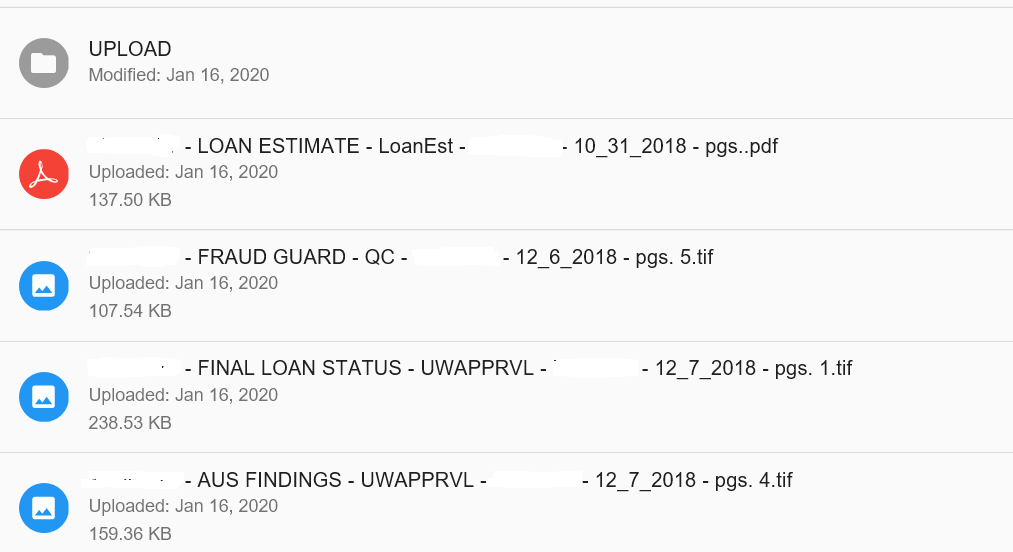

Automating External Sharing Securely

To automate the provisioning of external sharing, the initial list of loan documents is located and then sent to a workflow process in which a EFSS folder is automatically created along with the subsequent, secured link for the loan folder and its associated documents. Since the creation of the link and the provisioning of the EFSS share are automated, you don’t have to worry about people performing the EFSS provisioning, link construction and sharing – potentially breaching security protocols or sending out broken links.

The secured link is not only automatically created, but it is also returned back and memorialized into the electronic form for audit purposes. The appropriate supporting loan documents located are “checked” off providing the auditor with a starting point for the document sharing process.

Throughout the audit process and receipt of audit documents requested, these additional items can be dropped into the EFSS location, eliminating the need for printing, manual paper file storage and manual digitizing of the paper documents - all while and making the items available immediately to anyone in the audit department, or external to the organization.

Once the audit has been completed, the documents obtained are then “swept” into a Content Services Platform system subsequently storing the documentation for future reference in a secured location where permissions may be granted for viewing. The EFSS contents are designed for secured, sharing purposes with external agencies by using a unique, secured link, eliminating the need to reprint and deliver paper all while simultaneously creating an audit trail as needed.

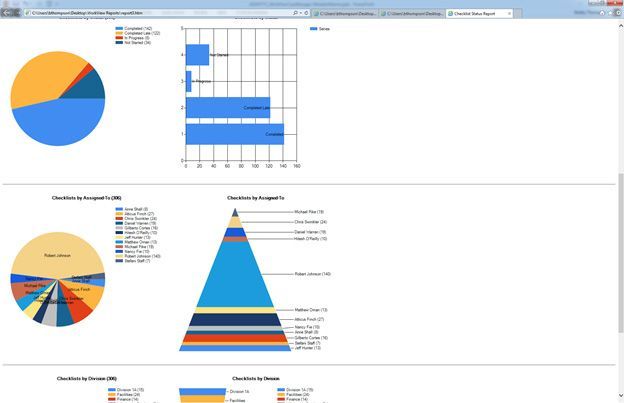

Dashboards and Reporting

The entire case audit history from beginning to end is memorialized – every person’s and/or system interactions involved throughout the audit process are logged providing the organization with a 360 degree view into the audit process – people, systems, tasks, dates, documents and processes.

Contact us for more information on our Case Management solutions for Auditing and Loan Processing services. We are based in Itasca, Illinois a Western suburb of Chicago, IL and serve clients nationwide.